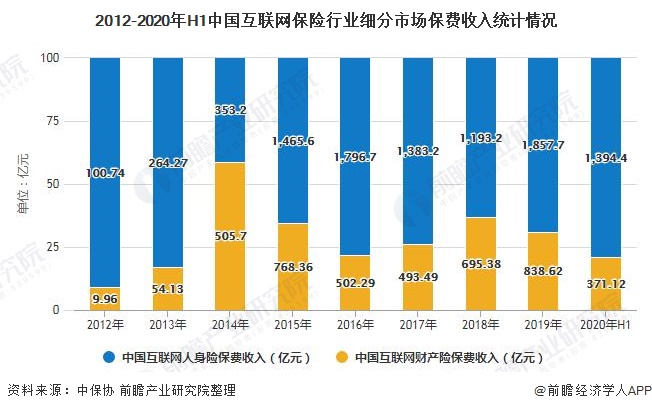

class: center, middle, inverse, title-slide # 互联网保险与智能投顾 ### 吴燕丰 ### 江西财大金融学院 ### 2021/06/11 --- ### 互联网保险 [《互联网保险业务监管办法》](http://www.gov.cn/zhengce/zhengceku/2020-12/14/content_5569402.htm) **互联网保险**是指保险机构依托互联网订立保险合同、提供保险服务的保险经营活动。 按经营形式可分为: 1. 传统保险公司信息化 2. 专业中介平台网销 3. 第三方电商平台 4. 网络兼业代理 5. 专业互联网保险公司 .footnote[ 来源:[前瞻产业研究院](https://bg.qianzhan.com/trends/detail/506/210310-beaf6d98.html) ] --- ### 互联网保险行业发展概况分析 <div id="htmlwidget-4e26d7a95acdc10afdeb" style="width:400px;height:400px;" class="grViz html-widget"></div> <script type="application/json" data-for="htmlwidget-4e26d7a95acdc10afdeb">{"x":{"diagram":"graph internet_insurance {\n rankdir = LR\n \n node [shape=box]\n A[label=\"互联网保险\\n经营主体\"]\n B[label=\"传统保险公司\"]; C[label=\"互联网中介平台\"]\n D[label=\"第三方平台\"]; E[label=\"专业互联网保险机构\"]\n F[label=\"其他主体\"]\n \n A -- {B,C,D,E,F}\n}","config":{"engine":"dot","options":null}},"evals":[],"jsHooks":[]}</script> .footnote[ 来源:[前瞻产业研究院](https://bg.qianzhan.com/trends/detail/506/210310-beaf6d98.html) ] --- ### 互联网保险行业发展概况分析 从2012年开始迅速发展。2020年上半年,互联网保险保费收入规模达¥ 1,766亿元。 | (单位:亿元) |保费收入|渗透率| |:---:|-------------:|-----:| |互联网人身险|1,394.4|6.6%| |互联网财产险|371.12|5.1%| 当前保险科技在行业的运用仅集中于销售环节,要实现高质量发展,打破行业痛点,需要将保险科技渗透到全产业链环节。 .footnote[ 来源:[前瞻产业研究院](https://bg.qianzhan.com/trends/detail/506/210310-beaf6d98.html) ] --- class: center #### 中国互联网保险经营形式分析情况 |类别|表现形式|特点|案例| |----|--------|----|----| |传统保险公司信息化|自有互联网平台,进行保险销售|忠实客户数量庞大,品牌认可度高。不受线下销售渠道限制,销售手续简单,产品高度标准化,但赔付和评估依然在线下。|太平洋保险、平安保险| |互联网中介平台|持保险经纪牌照|与保险公司合作,销售上千种产品,产品丰富、险种齐全|慧择网、中民保险、悟空保| |第三方电商平台|在第三方电子商务网站开展保险业务|第三方电商平台提供技术和用户流量|蚂蚁保险、微保、苏宁保险| |网络兼业代理|互联网平台兼业代理|银行、航空、旅游等非保险公司通过代理保险企业,销售相关产品。|携程旅游、途牛网、12306| |专业互联网保险公司|拥有互联网保险公司牌照|全线上,不设线下实体门店|众安在线、安心产险、泰康在线、易安产险| --- ### 互联网保险  备注:2016年-2018年,监管机构对保险产品进行专项清理,互联网人身险保费下滑导致互联网保险渗透率下降 --- ### 互联网保险  --- ### 互联网保险  --- ### 保险科技 目前互联网保险更多效仿电商平台的比价、场景、货架等模式,实现险企-产品-客户的透明化连接。如四家专业互联网保险公司无需在各地设立分支机构,便可直接在线上销售特定品类的保险产品;传统线下销售需各地分支机构获批开设网点。 而通过保险科技赋能,销售渠道仅为其中一个环节,未来保险科技将渗透到产业链的全部环节:产品设计、定价、营销、核保、承保、风控、理赔、运营等,提升公司运营能力、风控水平,改善用户体验。 .footnote[ 来源:[前瞻产业研究院](https://bg.qianzhan.com/trends/detail/506/210310-beaf6d98.html) ] --- class: center <img height=620 src='https://dfscdn.dfcfw.com/download/D25194701779485365754.jpg'> --- ### 阅读资料 - http://www.woshipm.com/it/3874315.html --- class: center, middle #### 特地留空 --- ### 智能投顾 [Robo-advisors (also spelled robo-adviser or roboadvisor) are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. ](https://www.investopedia.com/terms/r/roboadvisor-roboadviser.asp) A typical robo-advisor collects information from clients about their financial situation and future goals through an online survey and then uses the data to offer advice and automatically invest client assets. - 数字平台:提供自动化、算法驱动投资服务,几乎无需人为监督 - 智能投顾大多数自动配置及优化被动指数策略,依据是均值方差最优化 - 便宜、低起始账户资金,几乎任何人都可以使用 - 最适合于直接投资,不是复杂投资的最优选项,比如财产计划 - 由于其相对新的技术特征和无人参与的原因,智能投顾被批评不够同情和精致。 .footnote[ 清华大学金融科技研究院:[《2020中国智能投顾行业评测报告》](http://www.pbcsf.tsinghua.edu.cn/portal/article/index/id/5116.html) ] --- ### 国外智能投顾平台 Best Robo-Advisors: - [Wealthfront](https://wealthfront.4fq8.net/c/328256/172939/3104?subid3=link&subid1=4693125&subid2=nf4010f72ad394db79b44c68002a867b203): Best Overall and Best for Goal Setting - [Interactive Advisors](https://interactiveadvisors.com/?&dd_pm=none&dd_pm_cat=robo&dd_pm_company=interactive_advisors): Best for Socially Responsible Investing and Best for Portfolio Construction - [Betterment](https://betterment.evyy.net/c/328256/476921/2299?subid3=link&subid1=4693125&subid2=nf4010f72ad394db79b44c68002a867b203): Best for Beginners and Best for Cash Management - [Personal Capital](https://www.personalcapital.com/wealth-management?&dd_pm=none&dd_pm_cat=robo&dd_pm_company=personal_capital): Best for Portfolio Management - [M1 Finance](https://m1finance.8bxp97.net/c/328256/704943/10646?subid3=link&subid1=4693125&subid2=nf4010f72ad394db79b44c68002a867b203): Best for Sophisticated Investors and Best for Low Costs - [Merrill Guided Investing](https://www.merrilledge.com/guided-investing?&dd_pm=none&dd_pm_cat=robo&dd_pm_company=merrill_edge): Best for Education - [E*TRADE Core Portfolios](https://us.etrade.com/what-we-offer/our-accounts/core-portfolios?&dd_pm=none&dd_pm_cat=robo&dd_pm_company=etrade): Best for Mobile .footnote[ https://www.investopedia.com/best-robo-advisors-4693125 ] --- ### Wealthfront - Account Minimum: $500 - Fee: 0.25% for most accounts, no trading commission or fees for withdrawals, minimums, or transfers. .pull-left[ Pros: - Terrific financial planning that helps you see the big picture - Goal-setting assistance goes in-depth for large goals, such as home purchases and college savings - Portfolio line of credit available - If you have multiple goals, Path shows you the trade-offs you’ll face - Tax-loss harvesting ] .pull-right[ Cons: - No online chat for customers or prospective customers - Larger accounts may contain more expensive mutual funds ] --- ### Interactive Advisors - Account Minimum: $100 for 62 of the portfolios; $5,000-50,000 for 27 other portfolios - Fees: 0.08-1.5% per year, depending on advisor and portfolio chosen .pull-left[ Pros: - Wide range of portfolios offered - Most portfolios include baskets of stocks rather than ETFs - Actively managed portfolios are run by boutique wealth managers, and clients mirror their trades - The PortfolioAnalyst tool lets you consolidate and track all of your financial accounts -Customers can borrow against their non-managed accounts at relatively low-interest rates ] .pull-right[ Cons: - Some of the actively managed portfolios have very high minimums - The process of opening and funding an account is more difficult than at other robo-advisories - Not immediately obvious what your actual costs will be - You need a large account and a high cash balance to earn interest on idle cash ] --- ### Betterment - Account Minimum: $10 - Fees: 0.25% (annual) for digital plan, 0.40% (annual) for the premium plan .pull-left[ Pros: - Quick and easy account setup - Checking and Cash Reserve features offer two-way sweep - You can sync external accounts to individual goals - Add a new goal at any time and track your progress with ease - Easily change portfolio risk or switch to a different type of portfolio ] .pull-right[ Cons: - Users of the planning function are constantly nudged to fund a Betterment account - The standard plan incurs a charge of $199–$299 to talk to a financial planner - Socially Responsible portfolios are invested in exchange-traded funds (ETFs) so are less controllable - There are no borrowing options against your portfolio ] .footnote[ https://www.investopedia.com/best-robo-advisors-4693125 ] --- |Company| Country| Assets under management| # of Accounts| |-------|--------|-------------------------|---------------| |The Vanguard Group| U.S.| $83 billion| | |Charles Schwab Corporation| U.S.| $33 billion| 223,000| |TD Ameritrade| U.S.| $20 billion| | |Betterment| U.S.| $14 billion| 361,809| |Wealthfront| U.S.| $11 billion| 216,599| |Personal Capital| U.S.| $8 billion| 18,308| |Wealthsimple| Canada| $4 billion| 100,000| |Nutmeg| Great Britain| $1.9 billion| 70,000| |Scalable Capital| Germany, Great Britain| $3 billion| 80,000| |Moneyfarm| Great Britain, Italy, Germany| $1 billion| 40,000| .footnote[ https://en.wikipedia.org/wiki/Robo-advisor#cite_note-30 ] ??? |FutureAdvisor by BlackRock| U.S.| $1 billion| 8,587| |Elm Partners| U.S.| $0.8 billion| | |Acorns| U.S. |$0.8 billion| 1.87 million| |United Income| U.S.| $0.4 billion| 318| |T. Rowe Price| U.S.| $0.4 billion| | --- ### 2020中国智能投顾评测分榜十强 .pull-left[ - 华夏基金的查理智投 - 京东集团的京东智投 - 浦发银行的极客智投 - 口袋财富的理财魔方 - 金融界的灵犀智投, ] .pull-right[ - 数禾科技的拿铁智投 - 中信建投证券的蜻蜓点金 - 中欧基金的水滴智投 - 南方基金的司南智投 - 乐融多源的璇玑智投 ] .footnote[ 清华大学金融科技研究院: http://www.pbcsf.tsinghua.edu.cn/portal/article/index/id/5116.html ]